Insurance Solutions

A scalable, modular platform for connected insurance

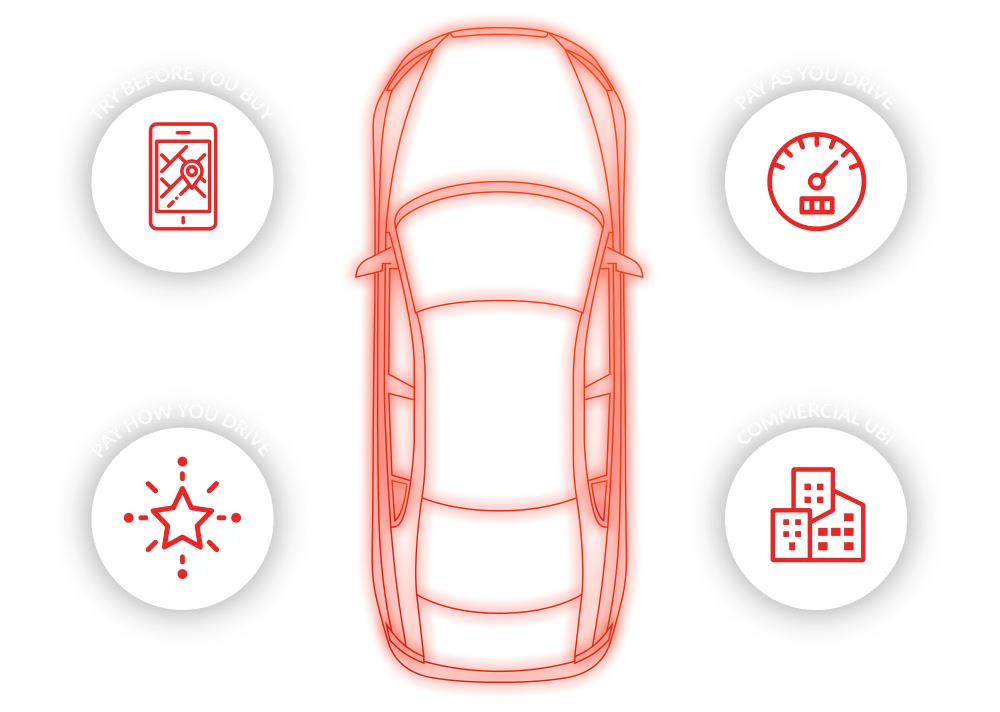

If you’re an auto insurer looking to reduce risk, streamline claims, increase customer participation and make a real difference to your bottom line, our solutions will deliver everything you need. Together, our highly configurable platform and our managed and professional services represent the world’s most complete usage-based insurance solution, affording unparalleled speed to market without limiting your flexibility to create your own programs and, crucially, build IP. IMS DriveSync is compatible with telematics data across all device types, from plug-in hardware to mobile apps and embedded telemetry within vehicles. The platform has already been adopted by numerous insurers such as RSA and auto manufacturers, including Volkswagen and Fiat.

End-to-end partnering

UBI that delivers ROI

Whatever your objectives, we work with you to build programs that deliver safer, more engaged drivers, and better insurance outcomes. Our flexible solutions leverage the best available methods of vehicle connectivity and user interaction to drive unparalleled results for our clients. Our platform enables global insurers to rapidly scale a variety of UBI programs, from fully-fledged risk-managed young driver products to lighter-touch claims-focused propositions with no driver behavior analysis.

Based on over 8 years of data and learnings from running our own direct to insurance company in the UK, as well as our proven platform, partners have full access to over 10 years of data and learnings from running our own direct to insurance company in the UK, including validated learnings in driver scoring (informed by real-world claims data), engagement, and rewards, as well as the effective use of telematics data directly within claims processes and to drive true behavioral modification for your drivers.

We are the only technology partner to have direct-to-consumer insurance expertise and we share our insurance experience and knowledge with our customers through collaborative workshops, proposition development exercises and go-to-market best practices to drive successful outcomes for your programs.

Find out more

Mileage-based insurance telematics programs

Find out more

Mobile Telematics Solution

Find out more

One App Mobile App Development Framework

Find out more

IMS Engagement Toolset

Find out more

SDK/Mobile SDK

Find out more

IMS Rewards

Connected Claims

Deliver loss ratio improvement with our connected claims capabilities

Our market-leading Connected Claims solution is now even easier to deploy thanks to the Wedge, our most affordable and flexible telematics sensor yet. Battery-powered and patent-protected, it is discreetly fixed to the policyholder’s windscreen and paired to a smartphone app in a simple one-off process. Deploying IMS’ low-cost Connected Claims solution unlocks double digit loss ratio savings for insurers, enabling reliable collision notifications as well as providing a clear picture of the circumstances for a faster settlement of liability claims and more efficient damage repair routing.

But it’s not all about you. Policyholders get peace of mind and an unparalleled claims experience, too. And if they want to explore other connected insurance programs, such as mileage-based programs or rewards-focused safe driving products, the same Wedge device enables you to deliver all of that, too.

Find out more

Connected Claims – our Claims-Focused Solution to Drive Loss Ratio Improvement

Customer Case Study

Zurich Insurance – a pioneer in deep use of telematics data in claims

White Paper

Improving Claims ROI and Claims Operations with Telematics Data

Commerical Lines

Serving evolving needs in fleet insurance

As Commercial Lines carriers increasingly struggle with poor underwriting results, our dedicated solution offers a highly-effective way to address the needs of insurers, fleet managers and fleet drivers alike. With multiple data collection options, leading fleet monitoring and risk management capabilities, engagement-focused feedback tools and policy and claims integration partners, it’s a winning solution for all stakeholders.

Commercial insurers finally have the proper tools to engage and retain customers and assess fleet risk to ensure a profitable book of business, including leading claims capabilities. Fleet drivers get regular real-time feedback to continuously improve driver safety. And fleet managers have the ability to increase operational efficiencies, appraise and reward fleet driver performance, and realize cost savings at every step along the way.

Find out more

IMS Commercial Insurance Telematics Solution

Customer Case Study

IMS Commercial Insurance Telematics

White Paper

The Real Value From Commercial Insurance Telematics